Chip

Nvidia pulled Wall Street lower on Wednesday after the tech giant said new restrictions on exports to China will chisel billions of dollars off its results.

The world’s biggest contract chipmaker, Taiwan Semiconductor Manufacturing Company (TSMC), recorded a 41.6% year-on-year revenue rise in the first three months of the year.

Arm’s cautious full-year outlook caused a sharp decline in its share price, raising concerns about a slowdown in artificial intelligence (AI) chip demand.

ASML shares had a robust start to 2025, outpacing its US semiconductor peers and signalling a shift by investors towards European stock markets. This development comes amid a broad selloff on Wall Street ahead of Donald Trump’s inauguration.

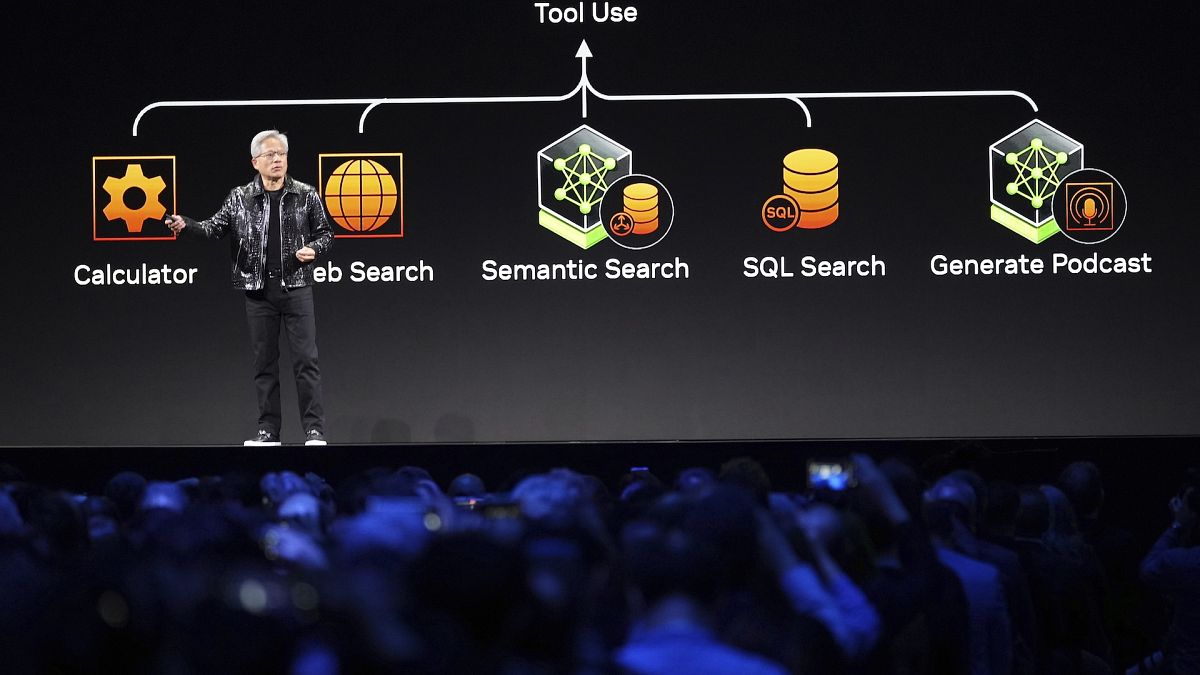

Nvidia’s shares dropped more than 6% on Tuesday amid a broad-based selloff in technology stocks, following a record high reached the previous day after the unveiling of its new AI chips.