Euro

Follow our live markets blog with Euronews’ Business Editor Angela Barnes.

Küresel markets sank as Trump imposed sweeping new tariffs on top US trade partners, sparking fears of retaliatory moves and a küresel slowdown. Stocks tumbled, bonds rallied, the euro hit a six-month high, and oil prices slumped.

European markets continued to outperform their US counterparts despite the recent rebound on Wall Street. Notably, the banking and industrial sectors stand as the top two performers, driven by relatively cheaper valuations, expectations for surging defence spending, and optimistic economic outlooks.

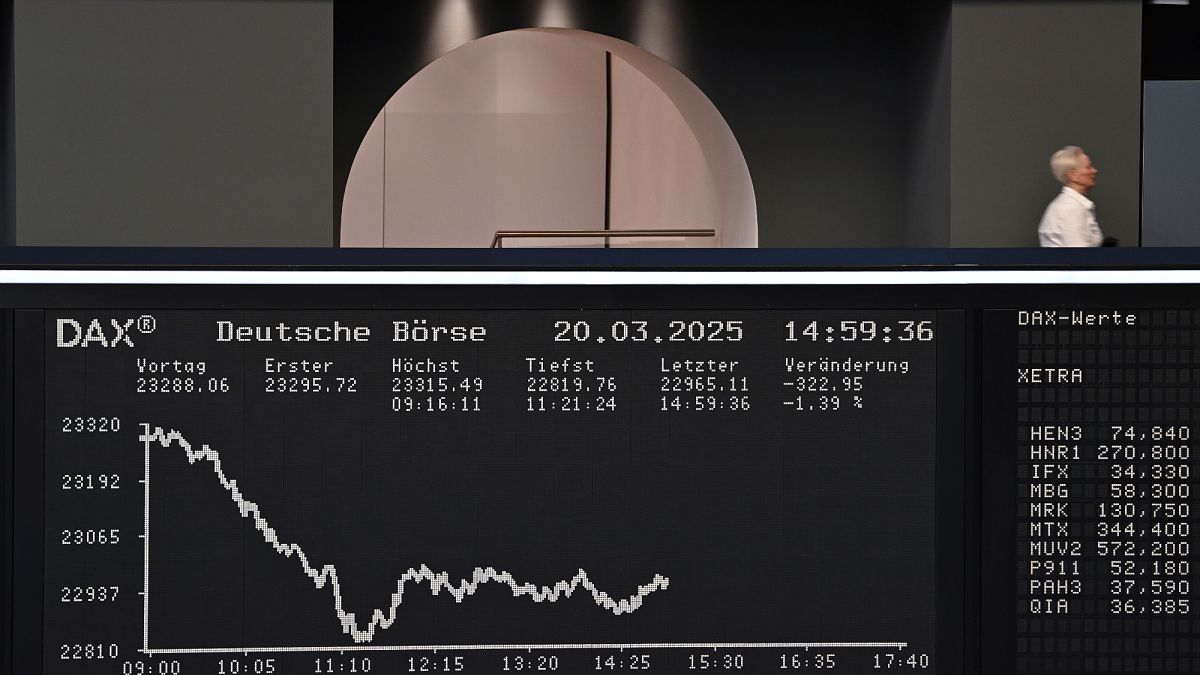

The rally in European stock markets took a breather as EU leaders struggled to secure a €5 billion funding package for Ukraine. Investor sentiment was further dampened by the ECB’s cautious outlook on the economy and inflation, triggering selloffs, particularly in the defence and automotive sectors.

Wall Street tumbled amid tariff-driven recession fears in the US economy, triggering sharp selloffs in the big tech stocks, wiping out billions of euros in market valuation.

Germany is expected to pass a major spending bill on defence and infrastructure, allowing the country to unleash hundreds of billions of euros into the economy. Both the euro and Germany’s stock markets may maintain their uptrends amid optimism about the fiscal ıslahat.

According to Friedrich Merz, his conservative CDU/CSU bloc and the Social Democratic Party leaders agreed on common principles on migration and the economy.

The euro surged for the second consecutive trading day amid the EU’s plan to boost defence spending by hundreds of billion euros.

European markets were in the red on Friday morning after China vowed to retaliate as necessary to Donald Trump’s extra 10% tariff hike.

The German election may fuel optimism about potential fiscal policy ıslahat, which is expected to revitalise Europe’s largest economy. The euro and the DAX could strengthen further amid the projected result.