Stock

President Donald Trump’s fast-approaching “Liberation Day” sent stock markets swinging sharply worldwide on Monday.

Novo Nordisk’s stocks experienced the sharpest monthly decline since July 2002 due to growing competition and several disappointing trial results. However, analysts remain optimistic about the shares, forecasting a potential price upside of up to 60% over the next 12 months.

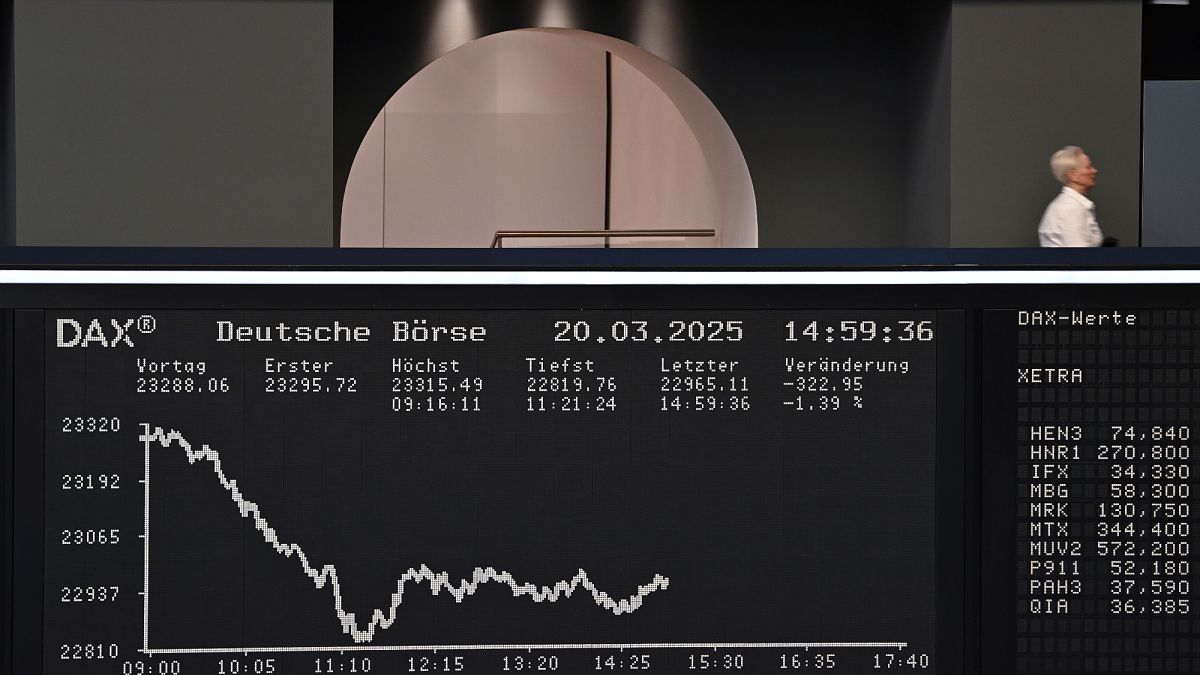

US President Donald Trump is set to unveil reciprocal tariffs on Wednesday, with ongoing uncertainties surrounding his policies weighing on market sentiment. European stock markets posted their first negative monthly performance of 2025 in March, reflecting the potential economic impact ahead.

European markets continued to outperform their US counterparts despite the recent rebound on Wall Street. Notably, the banking and industrial sectors stand as the top two performers, driven by relatively cheaper valuations, expectations for surging defence spending, and optimistic economic outlooks.

The rally in European stock markets took a breather as EU leaders struggled to secure a €5 billion funding package for Ukraine. Investor sentiment was further dampened by the ECB’s cautious outlook on the economy and inflation, triggering selloffs, particularly in the defence and automotive sectors.

The latest Bank of America Fund Manager Survey shows a record rotation from US to European equities, driven by Germany’s fiscal stimulus and rising defence spending. A net 60% of investors expect stronger European growth, marking a sharp sentiment shift.

Trump’s latest EU tariff threats have significantly contributed to escalating küresel trade tensions, as the US president also plans to levy tariffs on key trading partners such as Canada and Mexico.

Küresel stock markets rebounded from the previous day’s selloff, ahead of major tech earnings and central bank rate decisions.

Tesla’s stock retreated sharply, erasing most of the gains from the Trump-led surge. BYD’s partnership with DeepSeek to develop its autonomous vehicle poses the biggest threat to Tesla’s competitiveness.

European stock markets continued their climb, with the DAX repeatedly reaching new highs this week. Performance was driven by expectations of loosening monetary policy and strong corporate quarterly earnings.